Enter Password

Payment Bottom Sheet

Payments Core

Year

2024-25

Type of Project

Payment Core

Company

PhonePe Pvt Ltd

Worked as

Lead Product Desginer

Case Study

Summary

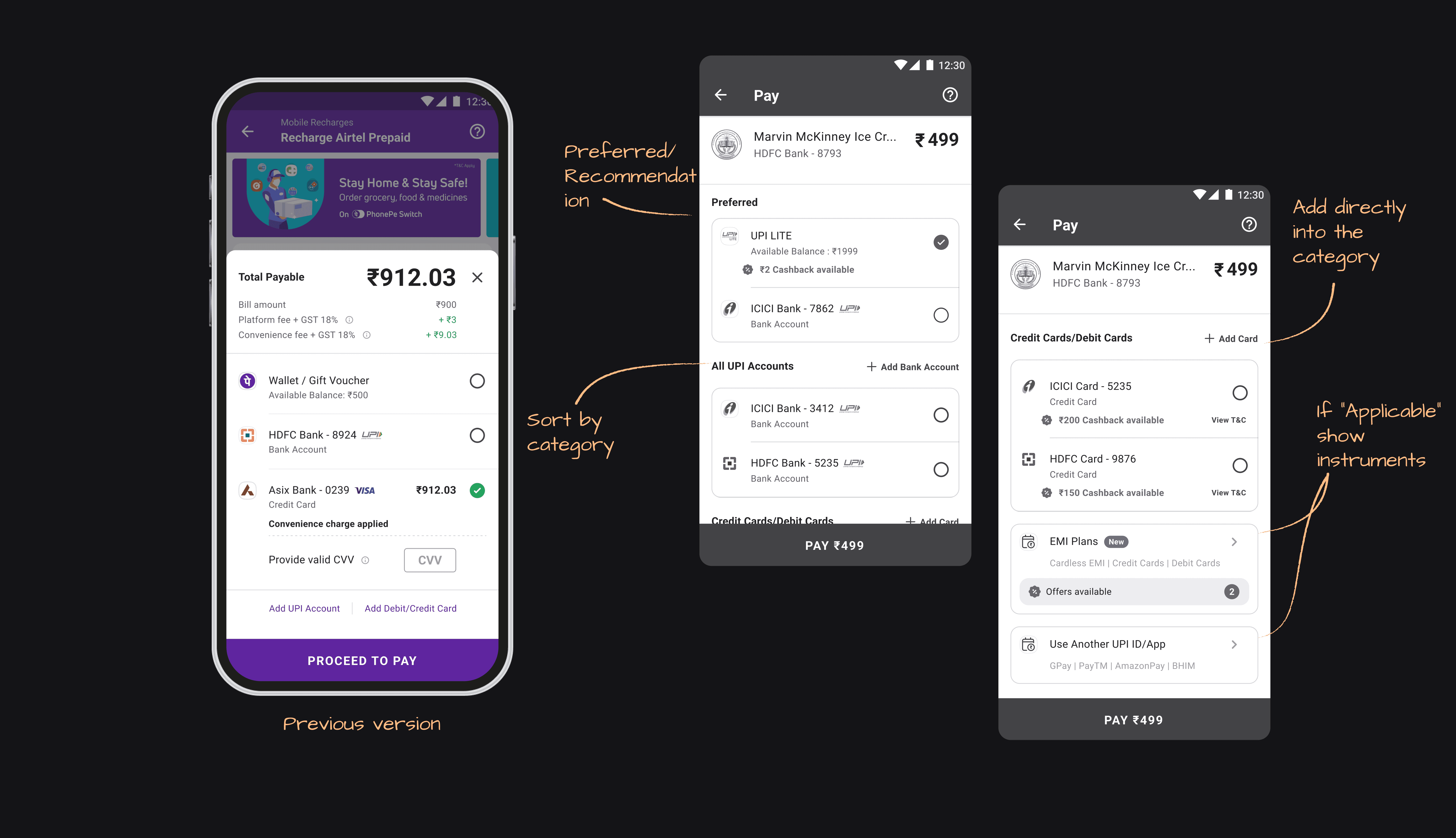

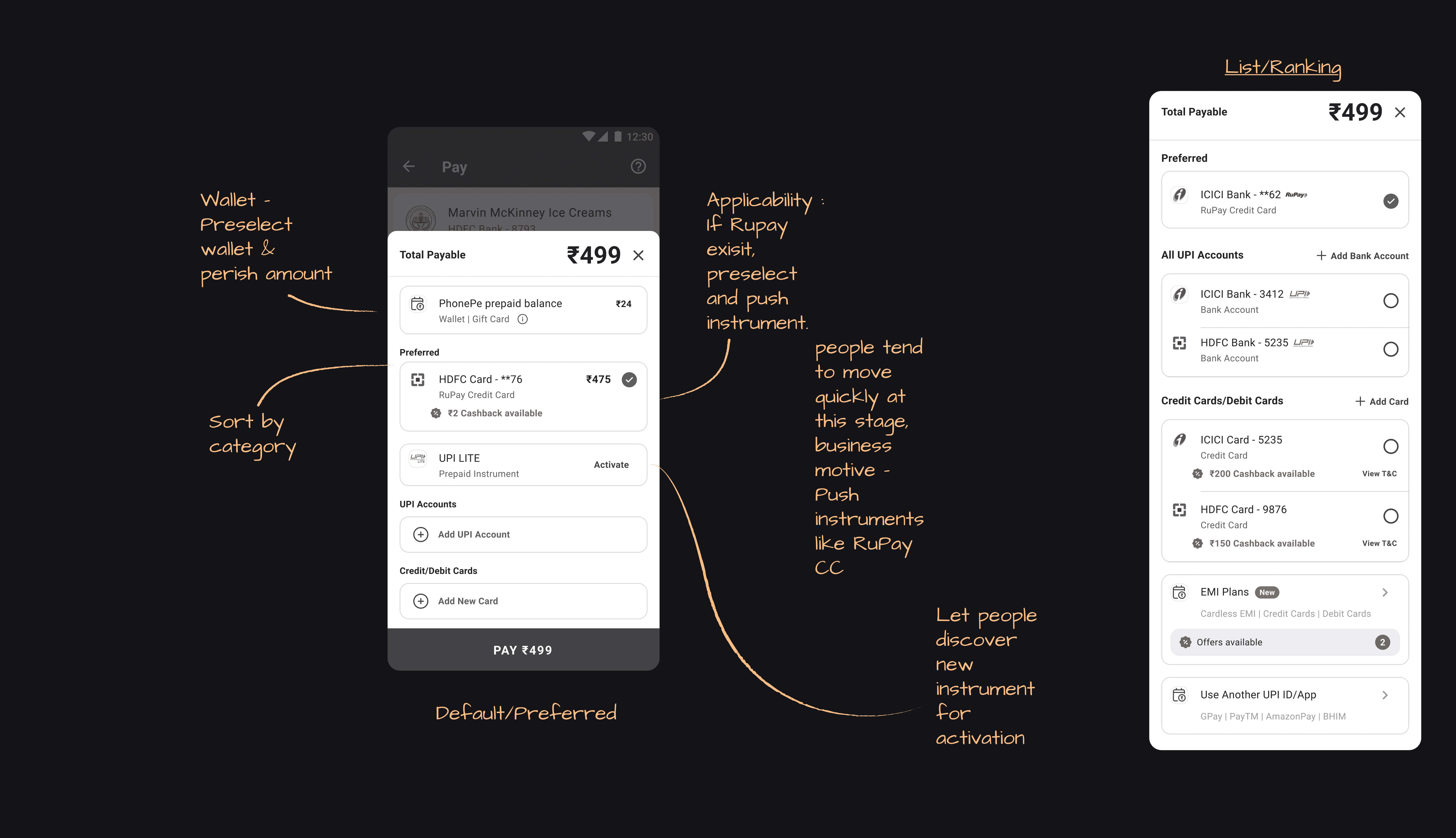

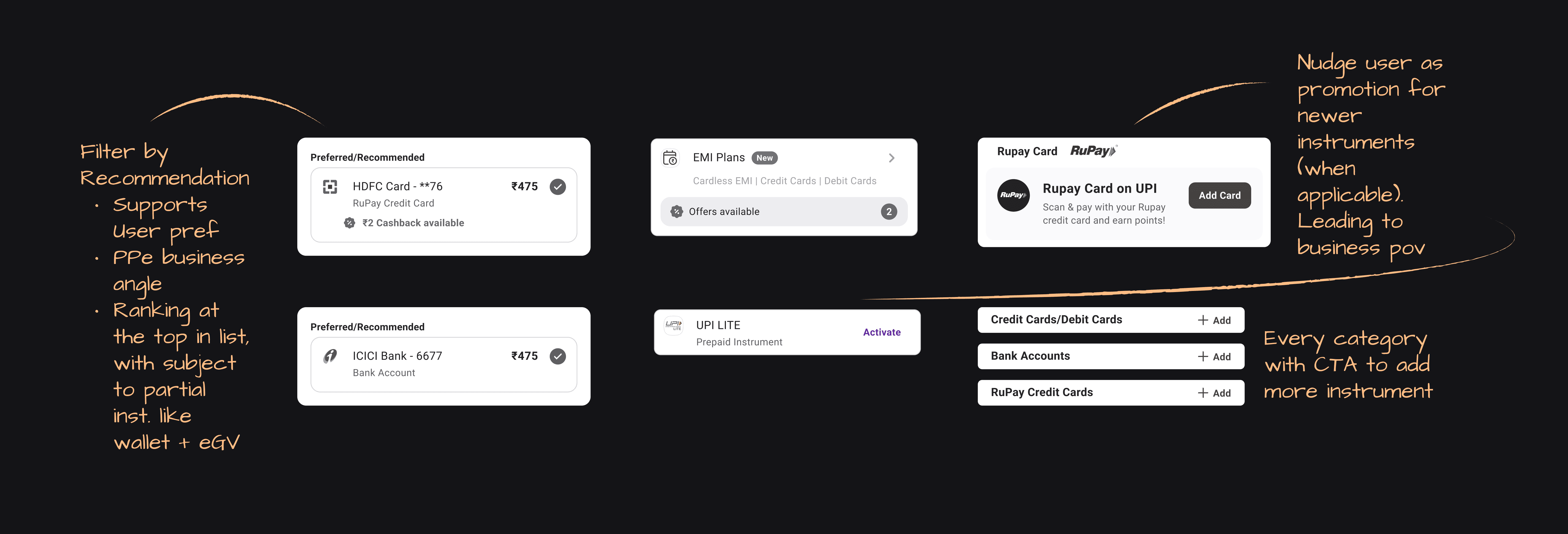

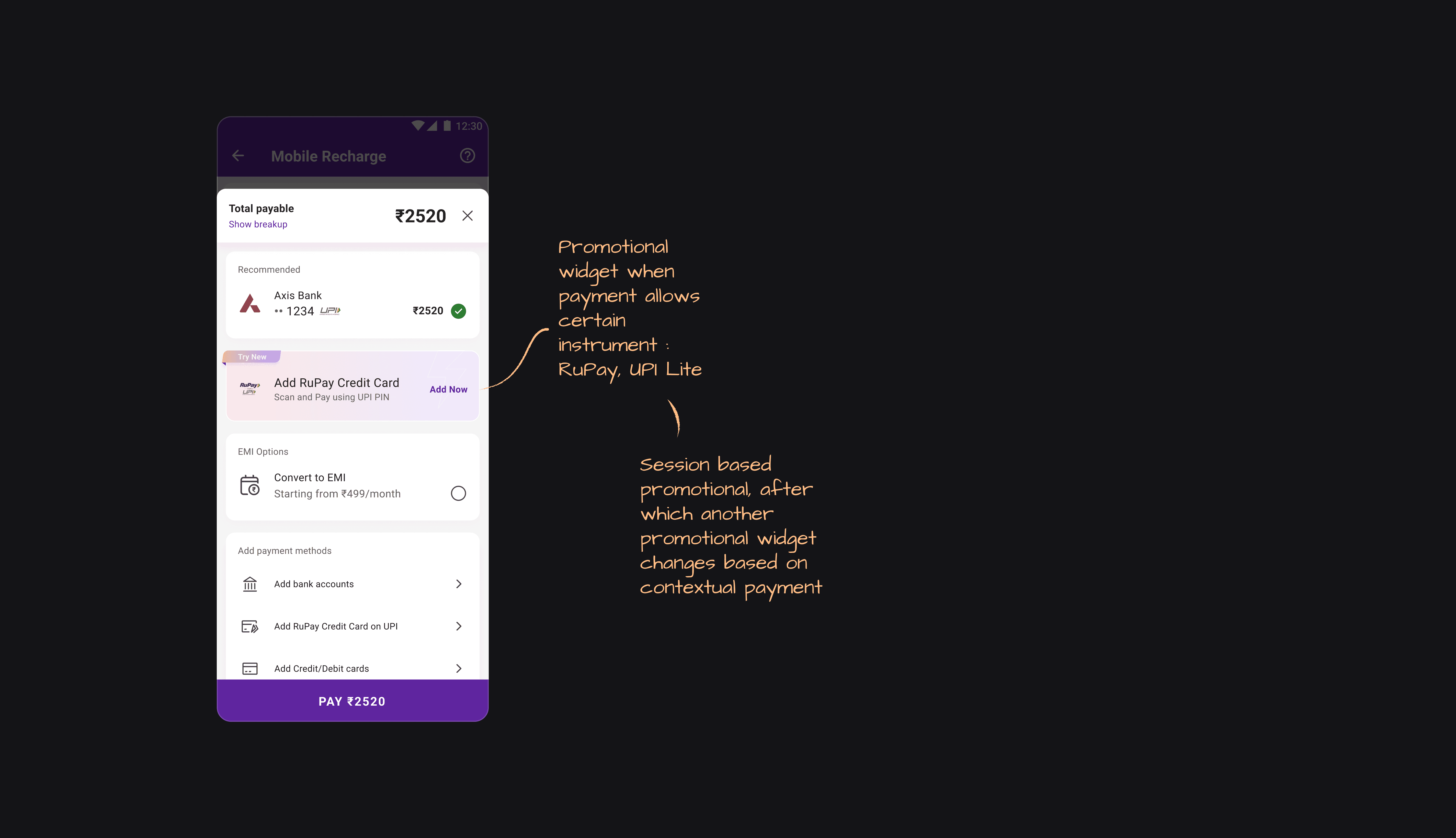

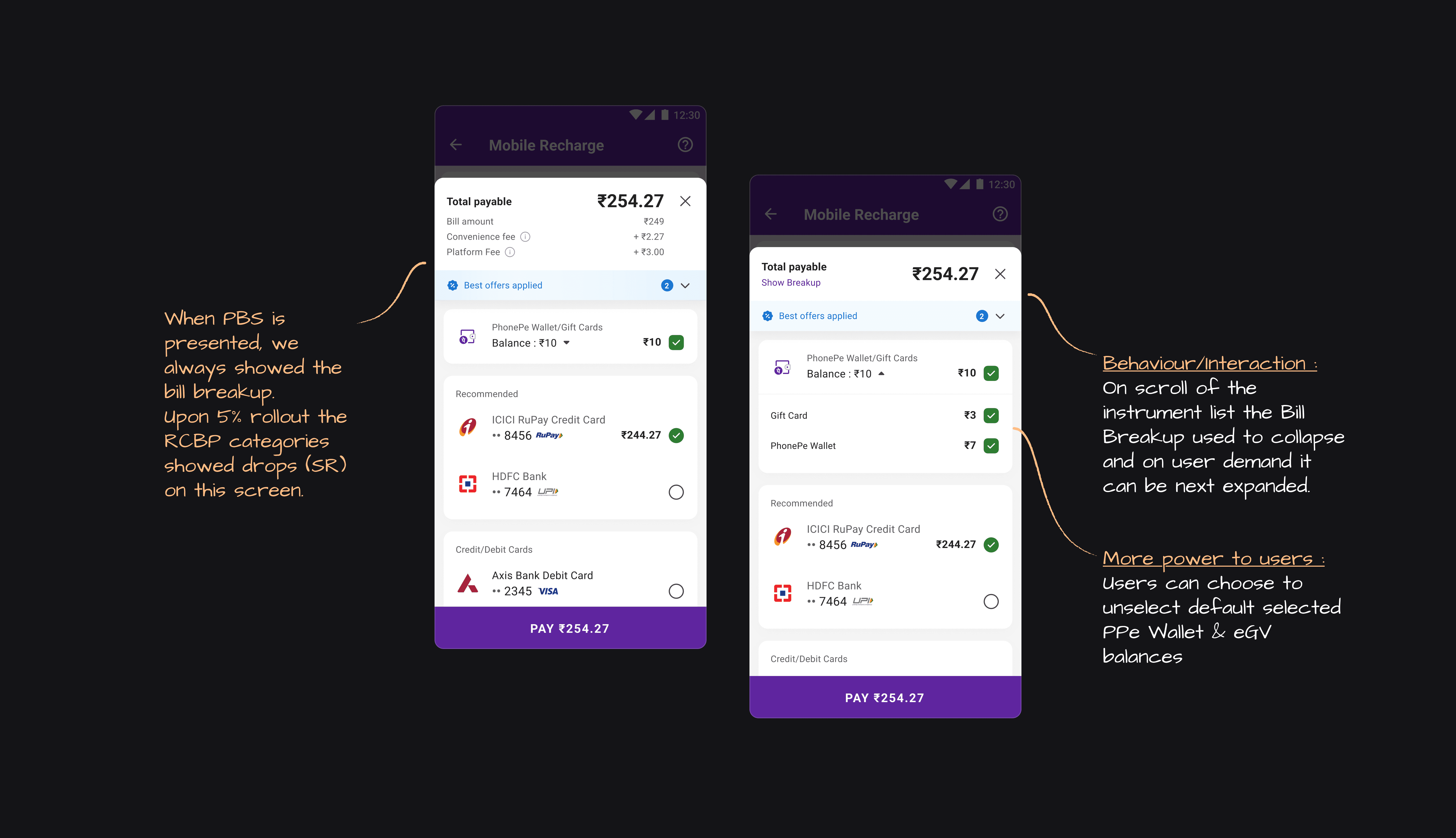

With the introduction of new instruments on UPI and the planned launch of PhonePe instruments such as EMI, BNPL, RuPay Credit Cards, and UPI Lite, the existing payment bottom sheet was no longer designed to scale.

The pay page needed to evolve from a static list into a decision-making system that could:

Promote revenue-contributing instruments

Drive adoption of new instruments

Optimize market share where required

Stay fast, familiar, and uncluttered despite growing complexity

Problem Space

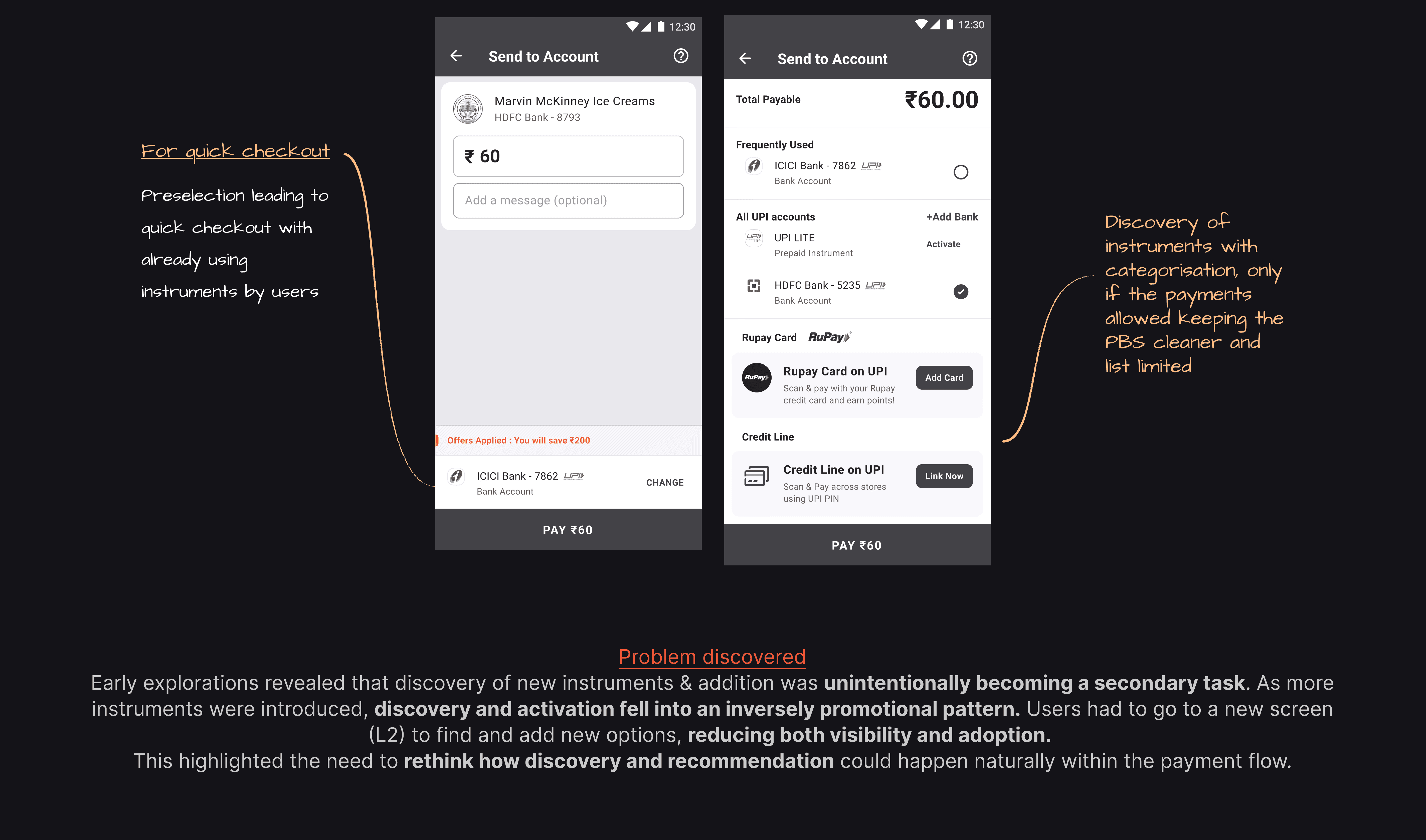

The challenge was to redesign the payment bottom sheet so it could:

Push adoption of new revenue-positive instruments

Increase usage of existing contributors (e.g. RuPay CC)

Optimize for market share (e.g. UPI Lite)

Remain decluttered and predictable as instrument count increased per user

This was not a visual redesign alone, it was a logic, behaviour, and systems problem operating in a high-frequency, low-attention moment.

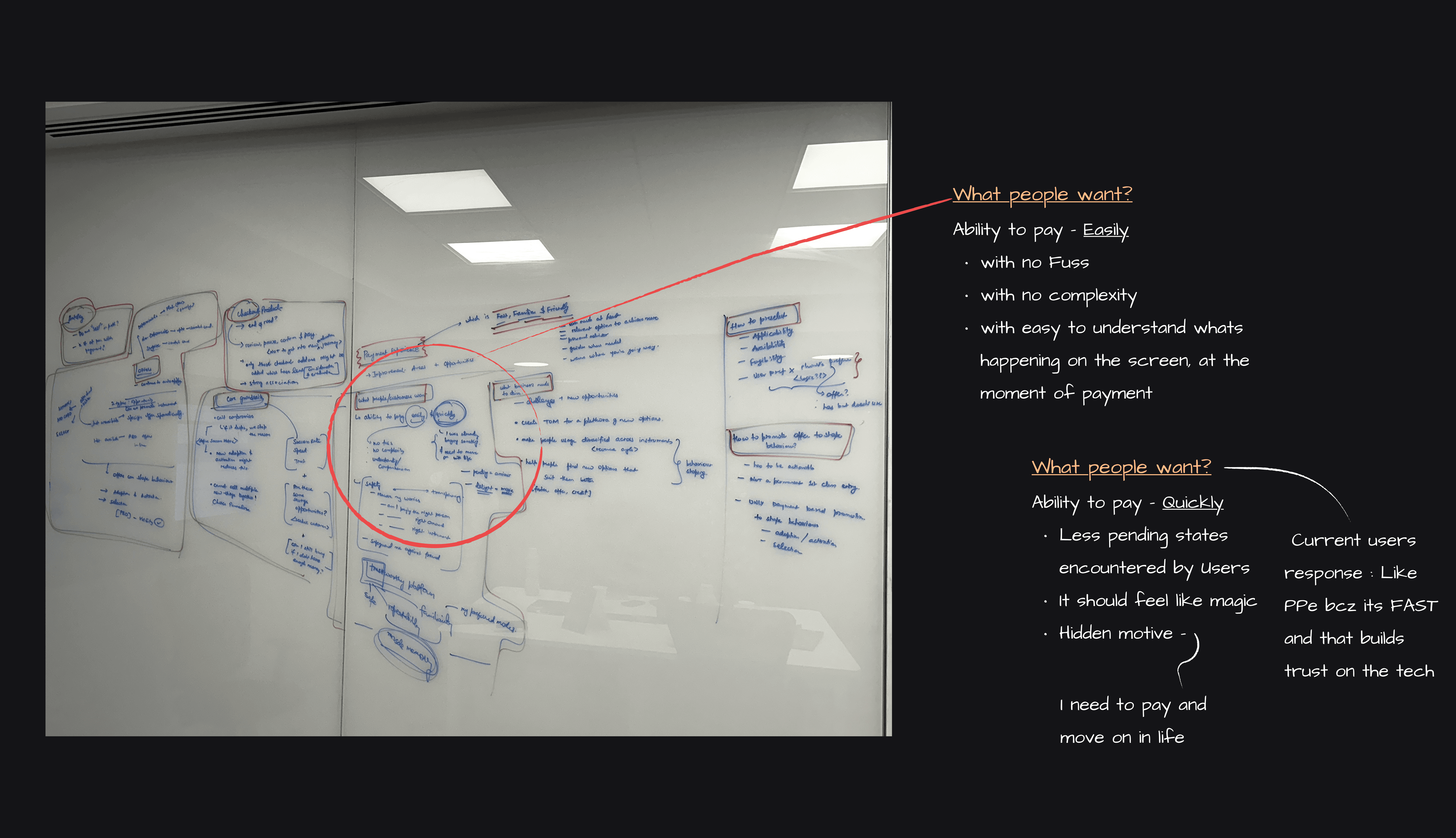

User Behaviour & Mental Models

From historical behaviour and internal analysis:

How users behave while paying

Payments are muscle-memory driven

Users do not want to compare instruments mid-flow

Speed and success matter more than exploration

Too many options lead to hesitation or drop-off

What users expect

Familiarity

Trust and safety

Transparency only when required

Ability to complete payment even with limited balance

These insights shaped a core principle:

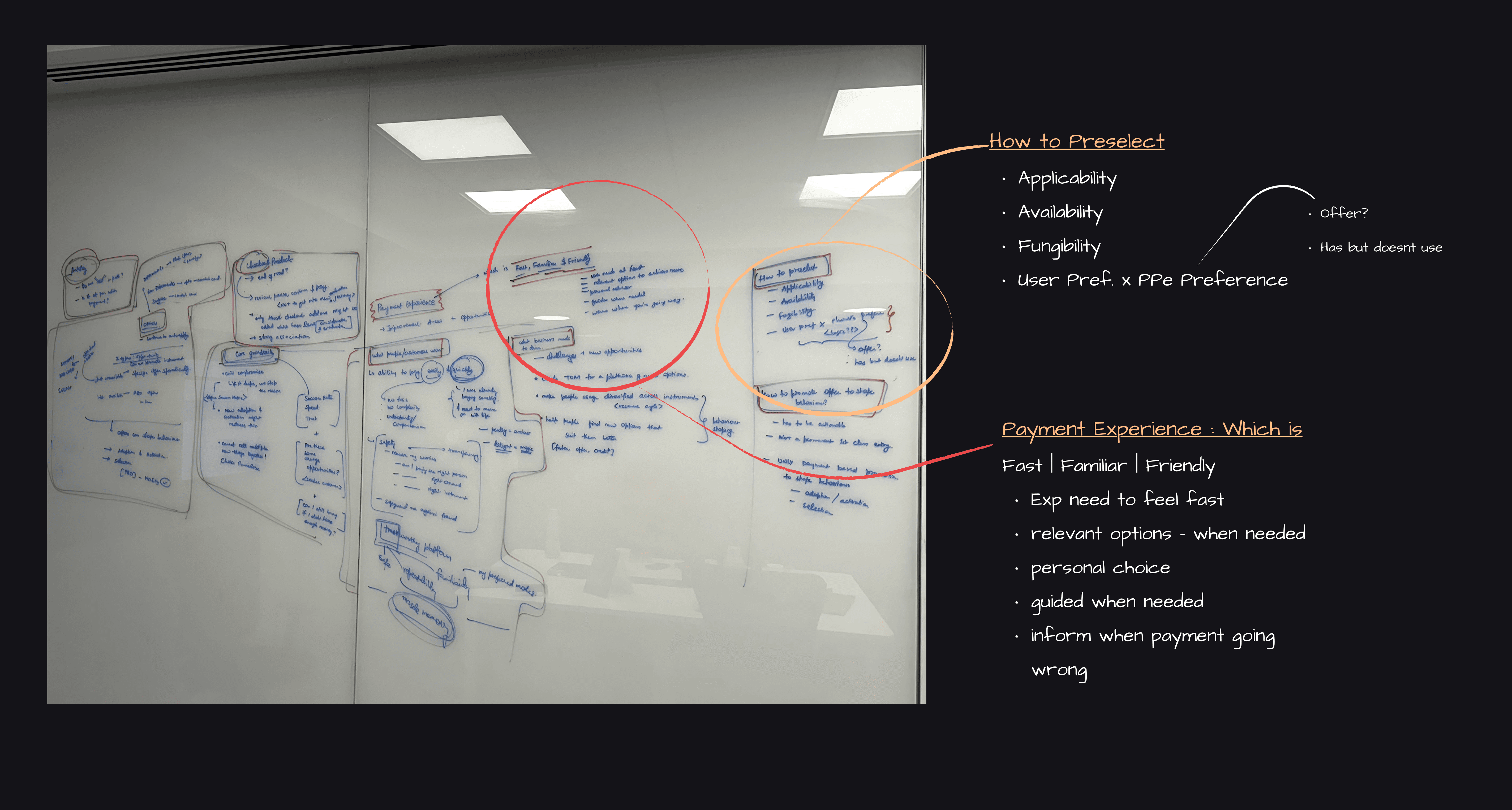

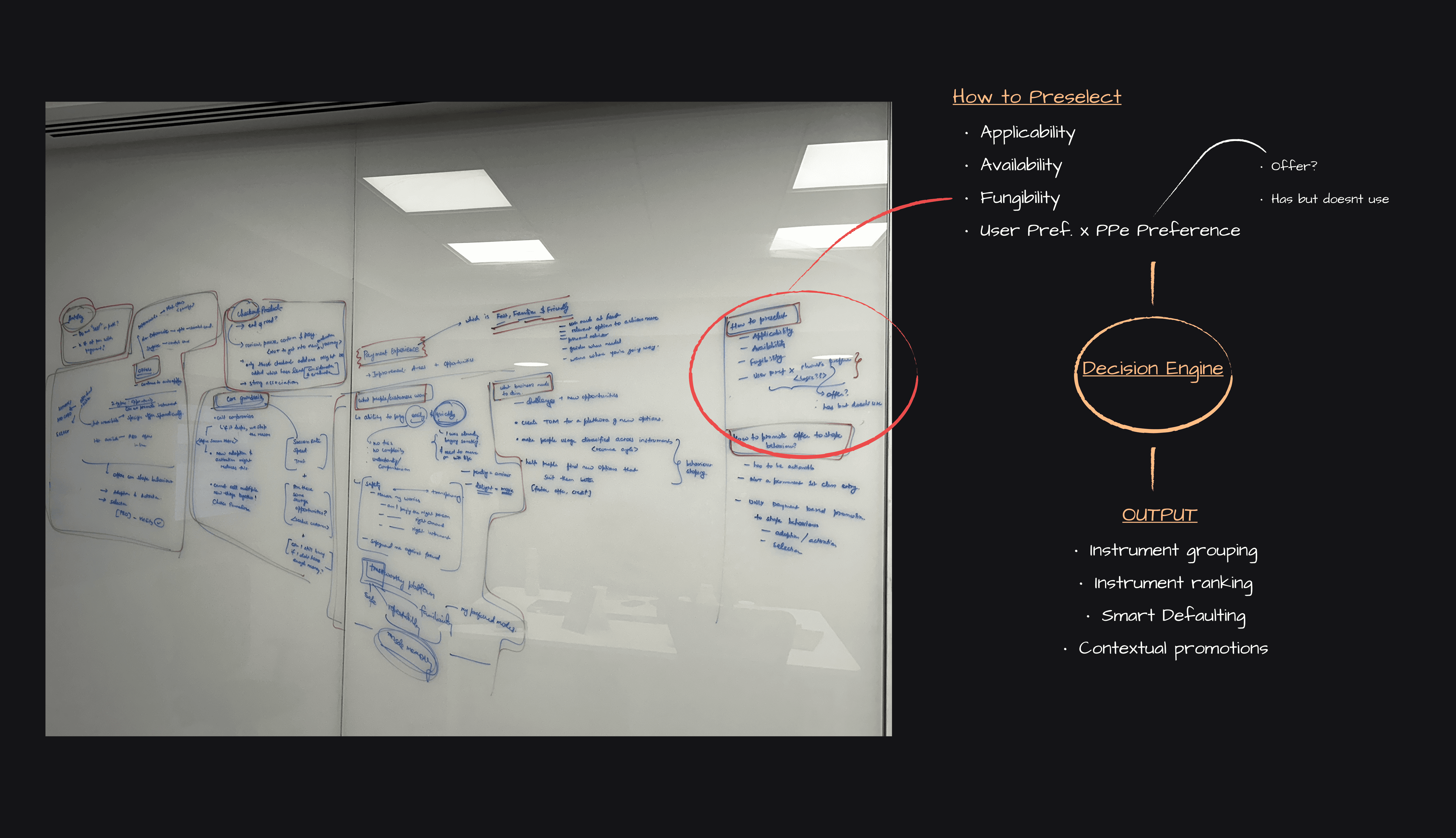

Reduce decisions. Curate choices. Default intelligently.

Constraints & Guardrails

Design Approach

System Design Overview

Key Decisions

Execution & Collaboration

Rollout, feedback & Iterations

Outcome & Impact

50% adoption of the new Payment Bottom Sheet

0.19% monthly increase in transactions

Contributing ~8 million additional transactions per month

(Metrics are directional)

Learning & Reflections

In payments, defaults beat choices

Ranking + recommendation outperform education

Systems thinking scales better than UI iteration

The pay page is a policy surface, not just a UI surface