Enter Password

Credit Cards on UPI

Card Distribution

Year

2024-25

Type of Project

Credit Cards - Cobranded

Company

PhonePe Pvt Ltd

Worked as

Lead Product Desginer

Case Study

Summary

PhonePe is a UPI-first platform where transaction scale and reliability are critical. With RuPay credit cards becoming interoperable with UPI, entering the co-branded credit card space became a natural extension of the payments ecosystem.

This case study covers the program-level design of PhonePe’s co-branded credit cards, focusing on how multiple card variants were launched and scaled through a shared application, approval, and management system.

Role & Responsibility

As the Lead Product Designer, I was responsible for taking PhonePe’s credit card distribution from 0 → 1, as this was the company’s first entry into the credit card business.

My responsibilities included:

Owning end-to-end experience design for credit card distribution

Partnering closely with Product, Engineering, and Business

Mentoring another product designer who worked alongside me

Given my prior experience designing RuPay credit card integrations, this project closely aligned with my earlier work and allowed us to move faster while handling new constraints.

Key execution areas:

Product Detail Pages (PDPs)

Pre-issuance flow

Card upgrade / downgrade flows

Post-issuance card management journeys

Overview

PhonePe partnered with multiple banks to launch co-branded credit cards that served different user segments and business goals.

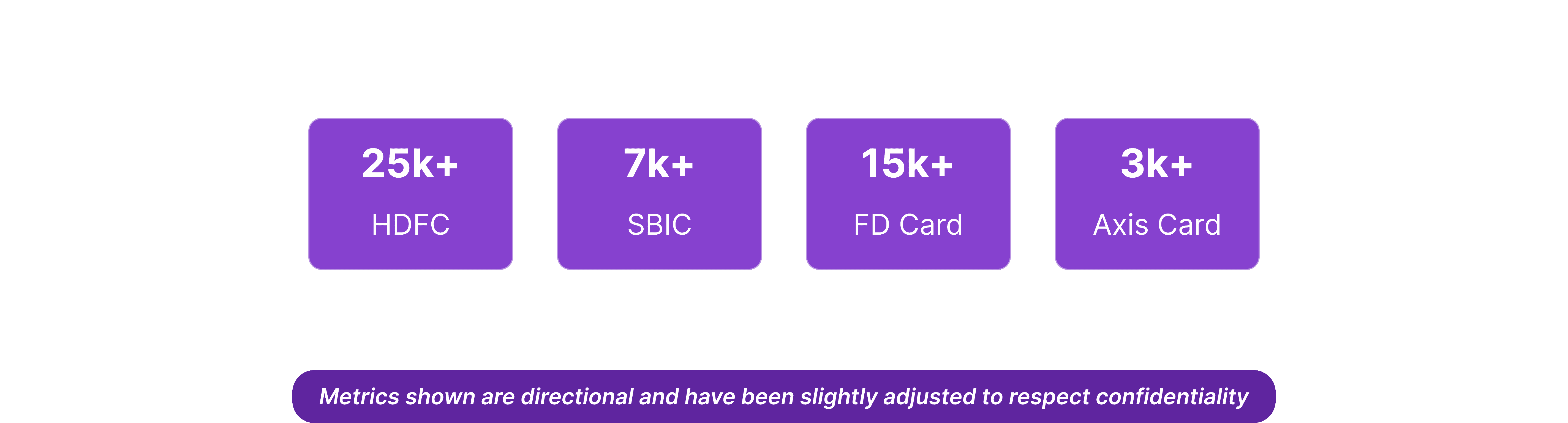

Card portfolio at a glance:

HDFC Bank: Mass and Premium variants

SBI Card: Mass and Premium variants

Utkarsh Bank: FD-backed credit card

While each card differed in positioning and eligibility, they all shared:

A common discovery and application system

Unified verification and approval logic

A shared post-issuance management experience

This approach allowed PhonePe to scale credit cards without building isolated systems for each partner.

Impact

Program launched in July'25

By December '25, ~1 lakh credit cards issued (making PPe 2nd in rank to issue cards)

HDFC led initial adoption due to early rollout

SBI and FD-backed cards followed as secondary launches

Context & Scale

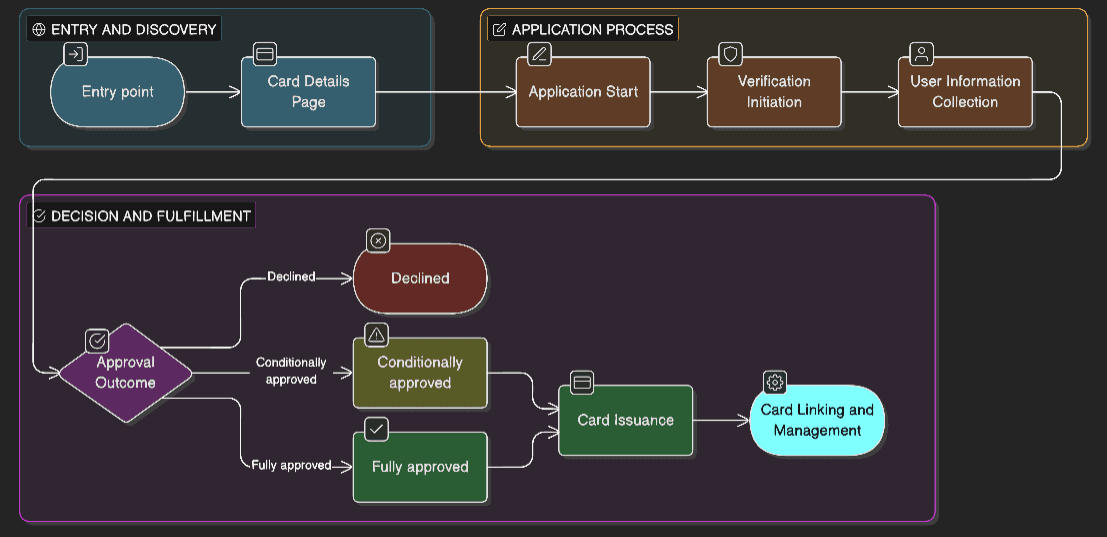

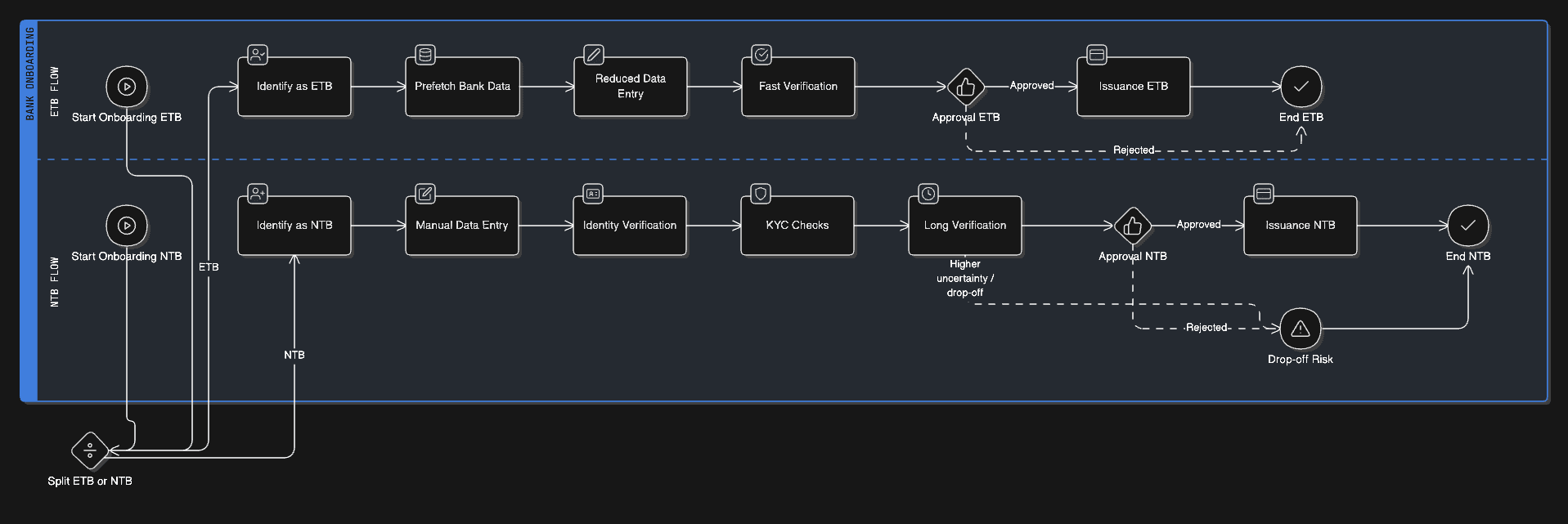

This was not a single linear flow, but a long, state-based journey with multiple paths depending on:

User type

ETB (Existing-to-Bank users)

NTB (New-to-Bank users)

Bank responses and verification outcomes

Regulatory and risk constraints

The journey spanned

Discovery and eligibility (including DRE handling)

Application

Verification

Issuance

Post-issuance management

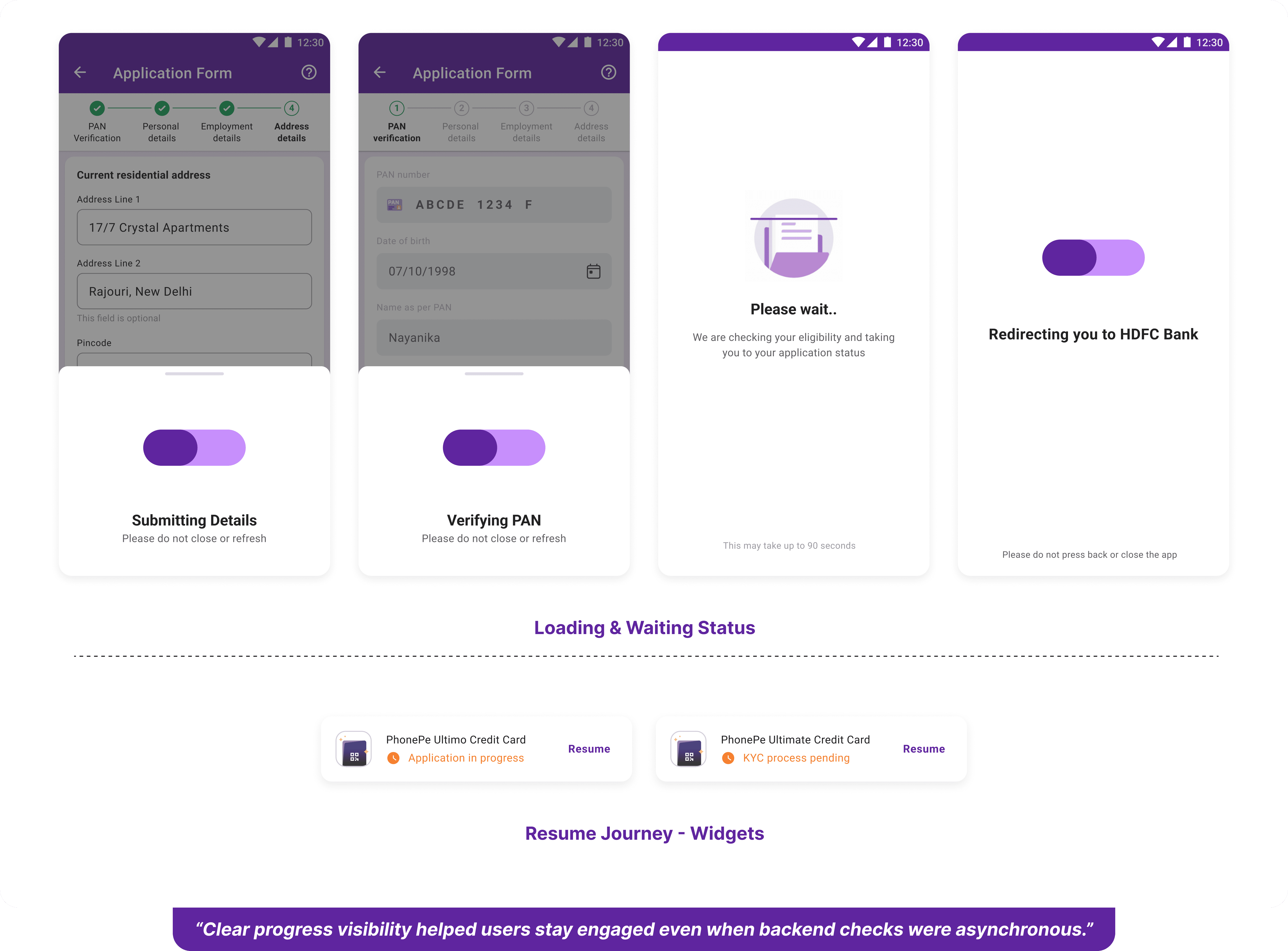

Additionally, the system had to support:

Multiple entry points

Resume states across sessions

Post-issuance actions (limits, upgrades, usage visibility)

Problem Statement

Users expect credit card applications to be simple and predictable, but in reality, credit systems are asynchronous, regulated, and failure-prone.

The core challenge was to design an experience that:

Felt simple and trustworthy to users

Handled complex backend states and bank-driven logic

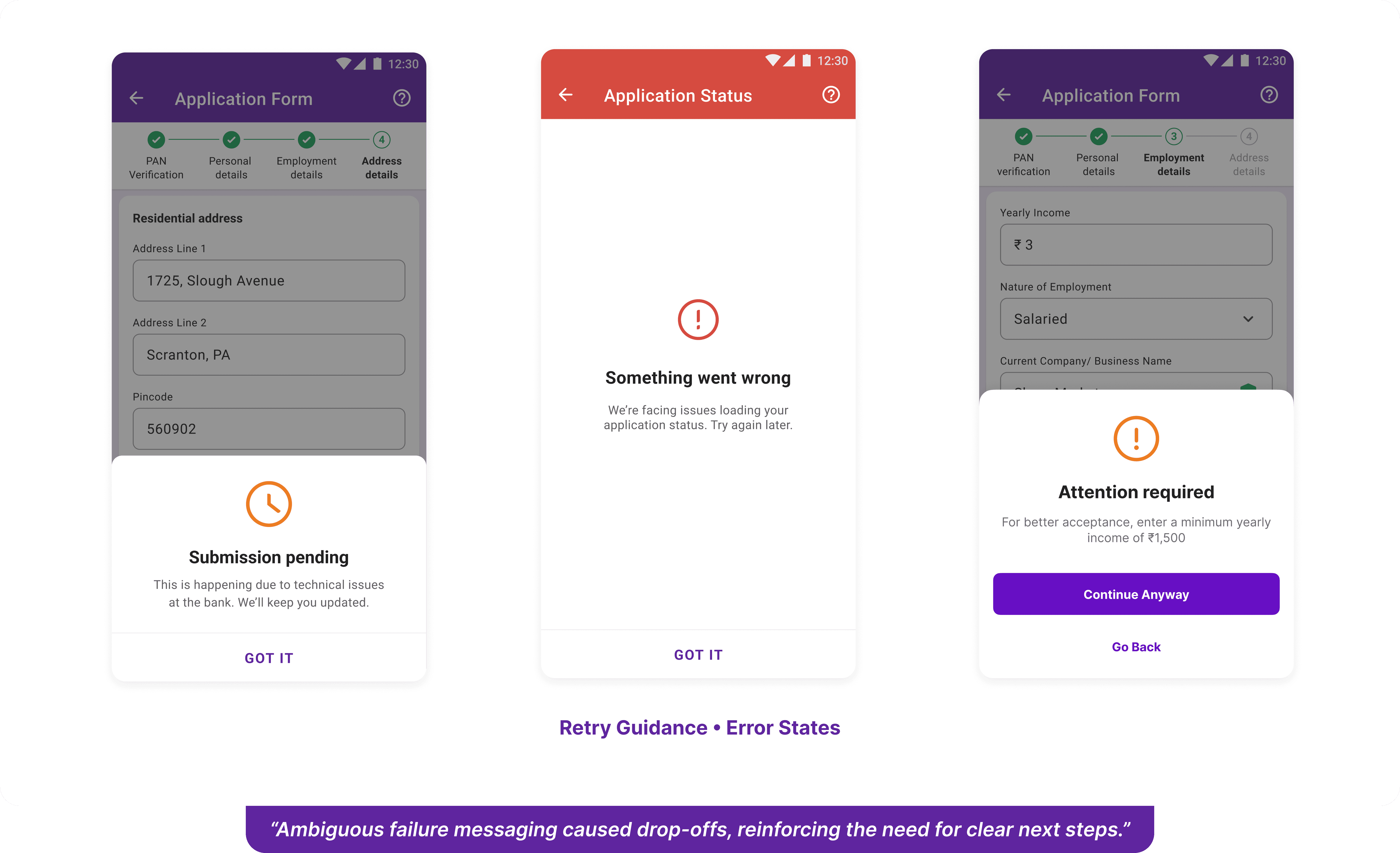

Reduced drop-offs caused by uncertainty and unclear outcomes

This was not just a UI problem, but a system-level design challenge involving trust, timing, and transparency.

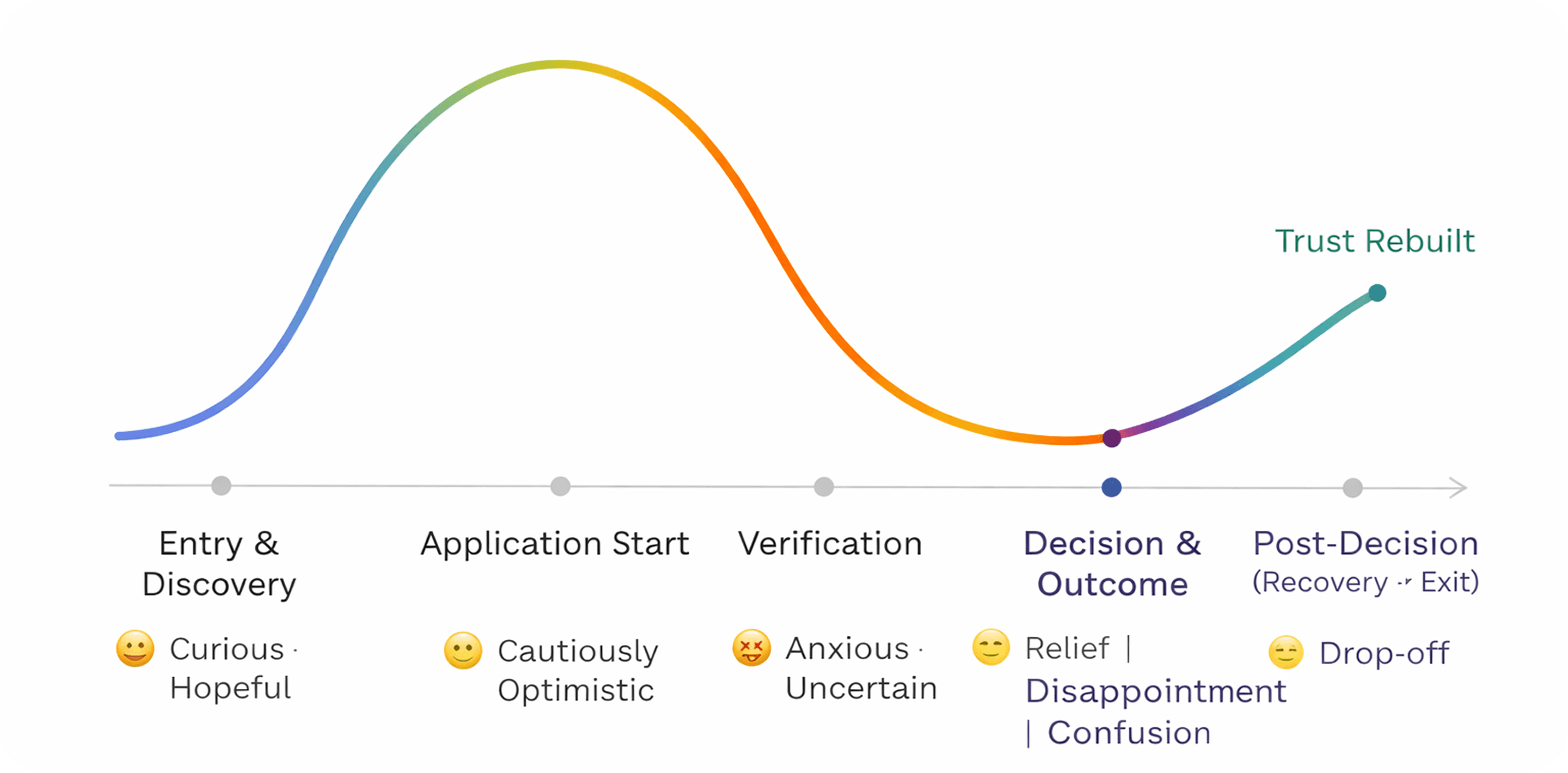

User Behaviour & Mental Models

Users approached credit cards with uncertainty and anxiety, especially first-time applicants.

Key behavioural patterns observed:

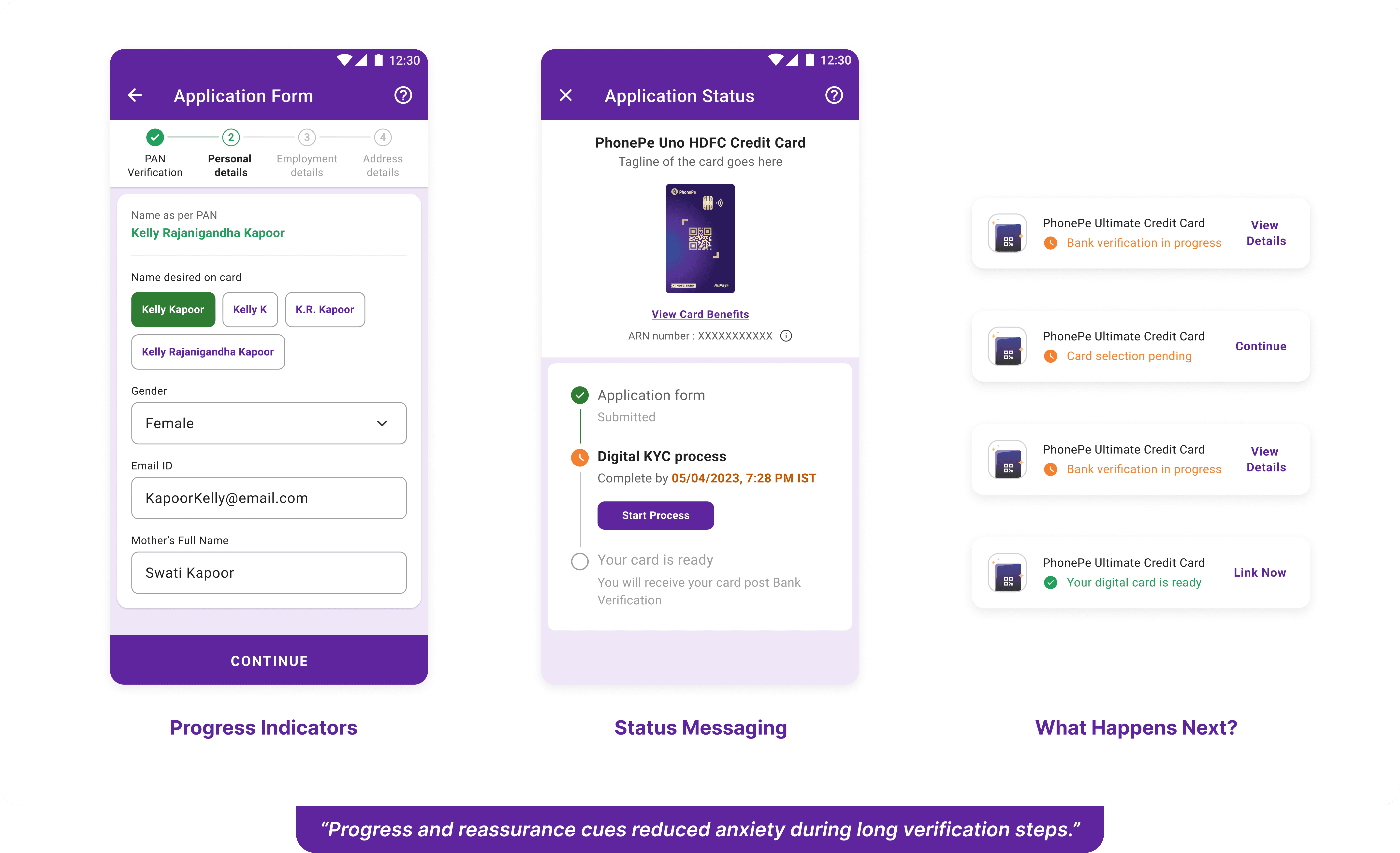

Users wanted constant reassurance during the journey

Progress visibility mattered more than speed

Unclear failures led to abandonment

Stage

Emotional State

Entry & Discovery

Curious • Hopeful

Application Start

Cautiously Optimistic

Verification

Anxious Uncertain

Decision & Outcome

Relief • Disappointment • Confusion

Post-Decision

Trust Rebuilt • Drop-off

"User behaviour showed increasing anxiety as the journey progressed, with reassurance and progress visibility becoming more important than speed."

Signals seen across the system:

Resume journeys

OTP retries

Error handling patterns

Decline messaging

Time-based purging

FOMO-based fee waivers

Core pain points:

Fear of rejection

Confusion about eligibility

Lack of understanding of banking logic

High sensitivity to ambiguous states

Insight 1 : Users wanted constant reassurance

Insight 2 : Progress visibility mattered more than speed

Insight 3 : Unclear failures led to abandonment

Constraints & Roadblocks

Platform constraints:

PhonePe’s LiquidUI required foundational tweaks to support complex credit journeys without breaking consistency.

Aggressive timelines:

This was a BAU-critical launch with limited room for iteration before go-live.Third-party dependencies:

Bank-controlled flows and responses constrained real-time UX decisions.

Injecting alternate methods for delight elements for users even with constraints from tech:

Key Decisions

Decision 1: When to Surface Eligibility

Problem:

Surfacing eligibility too early increased anxiety and drop-offs, while delaying it risked wasted effort.

Decision:

Eligibility signals were progressively revealed, only when users had sufficient context and intent.

Decision 2: Designing Decline as a State, Not an End

Problem:

Hard rejections caused abrupt exits and loss of trust.

Decision:

Decline states were designed with clear explanation, and also used later for cross-selling secured credit cards.

Decision 3: What to Hide vs What to Show

Problem:

Showing everything created overload; hiding too much reduced trust.

Decision:

Only actionable and reassuring information was surfaced, while system-driven logic stayed behind the scenes.

Trade-off:

The experience felt simpler, even though the system underneath was complex.